Have the latest info on mortgages, family security, and you may refinancing within mortgage brokers blog site. First-go out homeowners and seasoned property owners the same find beneficial and you can current information on the latest large arena of mortgage credit.

If you are searching for a good mortgage when you look at the Tx, you aren’t alone. Now, new Solitary Star Condition hosts more twenty eight billion people. The newest housing marketplace is fairly hot, which have home values having enhanced a very good seven percent ranging from .

Which have home values growing, its wise for the first-time homebuyers nowadays to complete everything you normally to help keep your construction can cost you down. This begins with providing a beneficial mortgage. And you may, since the FHA finance render low interest rates, down payments as little as step 3.5%, and you may an ultra-lower 580 credit rating demands, they have been often some of the most prominent money to possess homebuyers as you.

In this post, we are going to feedback the best FHA recognized loan providers inside Texas and exactly how they can let assist you on your own trip so you’re able to home ownership.

While Rocket Home loan because of the Quicken Money can be acquired from the country (not only in Tx), that does not enable it to be people a reduced amount of the best choice. Skyrocket Mortgage’s sleek on line app techniques means that you can aquire pre-recognized to possess a keen FHA mortgage in just a matter of moments.

Plus, their effortless-to-supply web site offers loan recording, in order to see if you get approved. It will together with assist you just what addiitional information you may have to render for those who don’t get approved.

If you find yourself the online service is extremely-ranked, you might still score assist toward mobile phone from just one out-of the FHA loan officials when you have issues or you prefer an effective little bit of even more assistance with the mortgage app techniques.

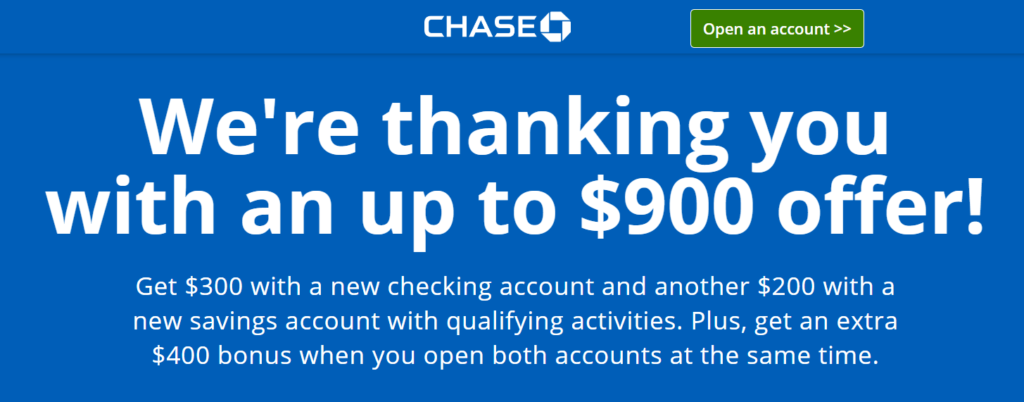

Colorado FHA Bank #2: Pursue Financial

Chase Home loan falls under J.P. Morgan Pursue & Co., one of the primary financial companies internationally. Thus, these are generally able to offer Colorado homeowners with quite high revenue on their mortgage loans.

One of the greatest advantages of having your financial that have Chase includes a sleek files and you will entry process, which will surely help save you money and time, particularly if you need to romantic rapidly into another domestic. And additionally, if you already lender having Pursue, you might qualify for additional discounts specifically customized to current Pursue customers.

Despite the fact that, be cautious with regards to fees. Chase generally speaking charge fees to possess price hair, mortgage origination, and you may underwriting, and the ones is also undoubtedly seem sensible if you aren’t attending to.

Texas FHA Lender #3: Financial of The usa

Bank away from The usa is actually a true financial behemoth, a whole lot more so than simply Quicken Fund or Chase. It has metropolises throughout Texas, so it’s a great selection for anyone who wants in-individual solution on the entire FHA loan processes.

Likewise, Financial of America is served by a strong online exposure, improved by recent discharge of its Mortgage Navigator software, you’ll find to have desktop and you can cellular. The software allows you to download documentation, e-sign models, while having pre-qualified for a loan.

Despite the great things about coping with Financial away from The united states, may possibly not function as fastest. Specific website subscribers point out that closings was delayed, and you can mortgage processing moments aren’t quite as timely as they imagine they might be.

Texas FHA Bank #4: Alterra Mortgage brokers

Alterra, an easy-growing mortgage lender, try becoming more popular through the Tx. This is exactly partly on account of Alterra’s run permitting Hispanic and other fraction homeowners achieve the house purchase process.

Latina anyone and you can families put about 70% of their clientele. Alterra focuses on looking to let borrowers which have strange credit records, numerous types of money, and multiple loved ones leading to an effective family’s money.

Just like the most other mortgage people we mentioned, Alterra possess a software, Alterra Pronto. Rather than other programs, this one brings consumers, manufacturers, lawyer, real estate professionals, label agencies, while some together observe and provide type in with the the grade of the mortgage techniques.

Tx FHA Bank #5: Secured Price

Mainly based inside il within the 2000, Guaranteed Speed is yet another one of many brand-new members towards the Colorado financial world. And, including the other programs we’ve got stated, Secured Rates keeps gone toward digital many years by providing a great 100 % free application, Digital Mortgage.

That it software lets consumers to test credit ratings, upload documents securely, and you will engage in virtually all one other components of new financial procedure. Indeed, you don’t also need certainly to talk to anyone to get approved (that’s a good otherwise crappy, according to your individual needs).

Protected Rates is proven to be instance knowledgeable about FHA money. Even though they actually do fees an especially highest navigate to website lending payment ($1,290 by 2018), their extra experience could make the mortgage process easier for particular consumers.

Shop around Before you Score a texas FHA Mortgage

Given that five lenders a lot more than are a great way first off looking for an FHA loan when you look at the Texas, they’re far from the actual only real alternatives you have. Whenever you are intent on obtaining the best deal, research multiple FHA lenderspare their interest pricing, charges, and settlement costs. Glance at recommendations off previous consumers who could possibly shed light on other factors, such as for instance customer care and just how punctual they could really close good mortgage.

More you are doing your quest with respect to getting a keen FHA financing, this new a lot fewer unpleasant shocks you’re going to have to face — together with extra money it can save you ultimately.