It can happen to anybody. You’d to fix the car, or somebody stole your own bag, or you didn’t score as many instances because you necessary on really works and from now on your book arrives and also you do not have it. Even although you is also encourage their property manager to allow you to pay two weeks late, exactly what will you do the following month? A personal loan to blow book can acquire your some respiration room.

What will happen or even pay rent?

If you can’t pay the lease, the consequences is severe, depending on your geographical area. At the very least, you’ll be able to bear a late fee (essentially 5% of book due) and perhaps a supplementary percentage if you find yourself more later (up to 10% of your own rent due).

Their rental record may become section of your credit report if their property owner spends a service so you’re able to report costs. Otherwise, for many who affect get otherwise rent property throughout the upcoming, late lease can cause the application as declined.

You are evicted if you don’t shell out your rent. In a few areas, a property owner is boot your aside that have three days’ notice. If in case you get-off whenever you are owing previous-due rent, new landlord may sue both you and receive a view. Judgments was public records and will create lots of damage towards credit score.

2 and you will don’ts while brief towards the rent

Knowing you will not be able to shell out their rent entirely and on time, deal with the difficulty at once.

- Manage inform your landlord in writing if you would like a number of a lot more weeks to create your book.

- Dont say-nothing and you will vow the landlord would not spot the shed commission.

- Manage give an explanation for characteristics of state, and if you would expect to resolve it.

- Dont wade blank-passed. A partial payment is superior to zero commission anyway.

- Do pledge written down to invest a full matter by good particular big date and keep that promise.

- Usually do not give only weakened reasons.

- Manage apologize for the late fee and you will promise to spend towards time in the future.

- Usually do not produce a be sure you simply cannot shelter. The fresh costs and aggravation might be greater.

Your own landlord will likely costs a later part of the commission. Do not battle regarding it. Although not, should your connection with the brand new landlord is right and you have not ever been later in advance of, you might inquire about a fee waiver. Particularly if you spend at the least area of the rent towards the big date.

Pay-rent that have an unsecured loan

The new steps listed above should be hard to done. How will you pledge to not ever skip a lease percentage again? When right after paying their month’s lease (late) you’ll have to developed second month’s lease straight away? How will you escape one period of being bankrupt for the first of the fresh week? By getting some cash you don’t have to pay into the complete ab muscles the following month.

A personal loan to blow lease can present you with one year or extended to capture on your own book commission. For folks who skipped a beneficial $step one,100 rent fee, you don’t need to assembled $2,000 the following month. Instead, you could potentially more sluggish pay one to $step 1,100000 over time.

If you pay rent which have a personal loan, you could change your credit score. A fees loan with a good installment records is pleasing to the eye towards the your credit history. In addition to this, after you spend the loan of, keep giving one to same monthly matter monthly into the own coupons. So that the the next time you may have a monetary disaster, you should have money to fund it.

How come a personal bank loan for rental performs?

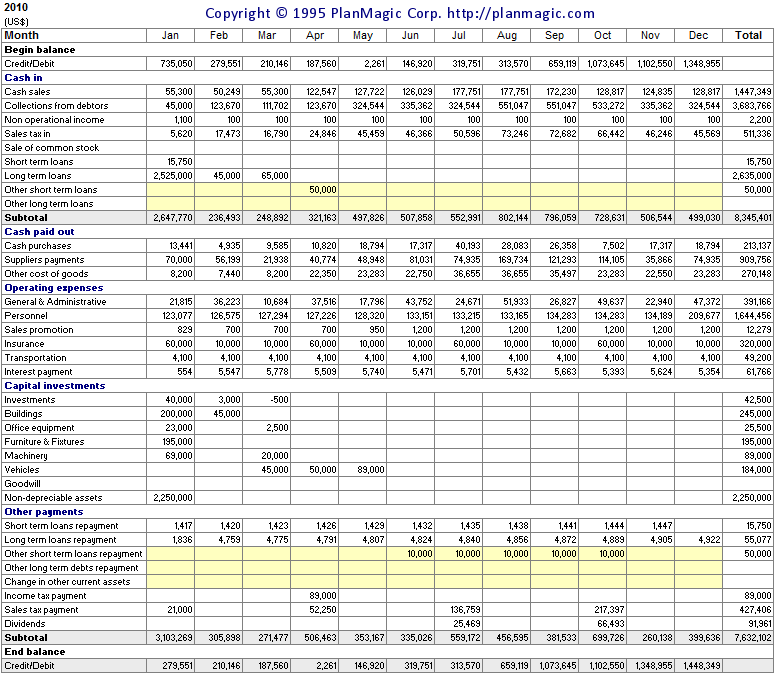

You will find personal loans from inside the quantity out of $step one,000 so you can $a hundred,000. Their interest rates include six% and you can thirty six% for many traditional lenders. When you are loan terms and conditions might be around a decade, just be in a position to protection a lease mortgage inside the several weeks or fewer. The newest graph less than shows how the amount borrowed and interest rate change the commission more than a single-seasons identity.

Percentage of the Amount borrowed and you can Interest rate

You can find consumer loan even offers on this website. Purchase the give that top suits you. Information about how personal loans functions:

- He’s unsecured, which means you dont put up a secured item such as for example an automobile or household.

Other ways to use your own personal mortgage

Needless to say, you dont want to use over you prefer otherwise can also be repay as concurred. But if you remove an unsecured loan for rent, you’re able to solve some other disease from the credit a good little a lot more.

If for example the personal credit card debt is actually highest, eg, you can clear they which have an unsecured loan. Personal loan rates of interest are often less than credit card notice pricing. And substitution personal credit card debt with an installment financing normally raise your credit score. An additional benefit is the fact with a personal loan, there clearly was a finish coming soon to suit your credit debt. And also make minimal percentage on your own plastic material virtually promises you to you Denver installment loans bad credit will be in financial trouble permanently.

Other a beneficial play with getting a personal bank loan will be to create a keen disaster fund. Therefore if something unanticipated appears, you’ll coverage they but still pay their lease punctually. Whether your rent try $step one,one hundred thousand, you can use $dos,100 and set the additional towards the a crisis savings account. Its around if you’d like it. Spend the money for financing out of within the a year. Incase you have got had no issues, you’ll have $step 1,100000 in the coupons.

After you pay off the non-public loan, always booked this new commission matter. However, this time around, include it with your family savings. While you are going various other year without issues, you will have more $step three,100000 into the deals.

In place of are swept up in a cycle of purchasing late and you may getting bankrupt, you will be on your way to financial safety. And having a good credit score. And you will and then make your own property owner happy, or at least also buying your own home.