Just what You will learn

It doesn’t matter if you may be yet another homeowner or someone who ordered their property decades back, refinancing The process of paying off your current home loan and you will substitution it which have various other to save currency or pay off your loan in the course of time. refinancing The process of paying off your home loan and replacing it with another in order to save money or pay your loan eventually. is actually an offered alternative that may help you save money. Once the many things can alter through the years, refinancing is also improve your old loan that have an updated the one that most useful aligns together with your current financial situation and you can desires.

If you believe refinancing is one thing you’ll need certainly to move forward which have, the next thing you have to know has been who you will refinance the loan. Surprisingly, it’s not necessary to re-finance with the same bank your has worked having for your completely new mortgage. And you should not feel you’ve got an obligation commit with the exact same financial when the various other has to offer a better rate.

Regardless, seeking a loan provider to suit your re-finance are a decision which will not hurried. Think about the process such as for instance another type of financial, instead of just refinancing. Take your time and you may would as often scouting into more loan providers, including your dated one, as possible. To make the decision a tiny much easier, we’ve got attained a number of the grounds you might want to stick with their bank otherwise look for top possibilities.

Refinancing Together with your Bank

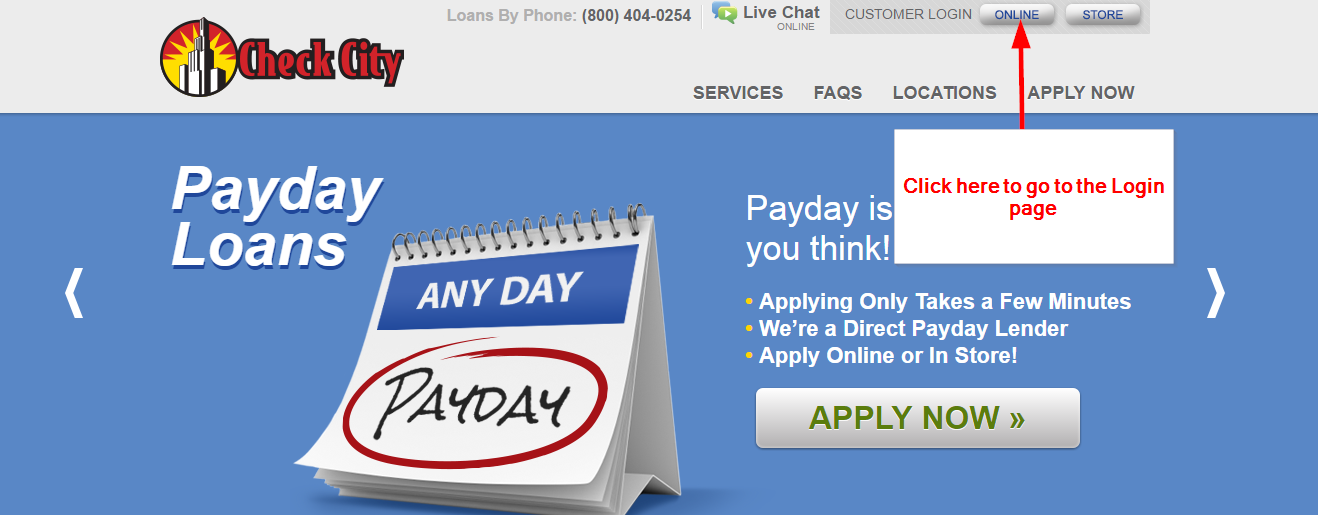

Within the no checking account payday loans in Madison Center for the dated and aside toward the! You’ll be able your cherished the last home loan experience, or maybe you may be a creature from comfort. Regardless of the reasoning, refinancing which have some one you worked with in earlier times has its own rewards.

For just one, it should be a seamless procedure. Conveniently, your dated lender have a tendency to curently have a few of your financial data files and you can records into the file, depending on how recently you caused her or him. That implies you simply will not need certainly to restart the loan techniques all of the once again. Yes, refinancing means you may be fundamentally replacement the loan with a new you to, however, that doesn’t mean the credit and you will percentage record might possibly be a secret on it.

Various other benefit of refinancing along with your most recent bank is you you are going to access down charges. Due to the fact you’ve already shown to be a trusting borrower, their lender you may cure certain will cost you, for instance the financing origination percentage Between 0.5% and you may step one% of one’s loan amount energized with the debtor since the payment getting handling. financing origination payment Between 0.5% and you may step one% of your own amount borrowed recharged to the borrower while the cost to have handling. . Again, nothing is protected, but saving cash try an excellent brighten if this happens!

Refinancing With a new Lender

Often, it’s sweet to begin with new the fresh home loan, the latest financial. An incident getting refinancing with a brand new financial you will arise when you can see most other lenders giving far more advantageous rates otherwise terminology to own your finances and needs. Another is if you had a bad knowledge of your last home loan. Supplied, you are going to need to submit and gives most of the documents (and several new ones) you once did for your former bank, nonetheless it you will all be worth it when you begin saving cash on the monthly home loan repayments.

Most likely, the new financial usually talk to the mortgage company, which means you won’t have to try to be a beneficial liaison involving the a few people. Yet not, the new bank could have specific contingencies that really must be done prior to the loan was refinanced. A few examples would be a home assessment, well evaluation, otherwise pest declaration. This type of contingencies could boost the big date before generally making they towards closure dining table.

Why you should seek information

You wouldn’t buy the first automobile your spotted online whenever car searching, so just why go with the original mortgage lender you will find?!

When you wish to re-finance, seek information! Your own mortgage could be the most significant mortgage you are going to previously just take away, thus investigation the options to ensure you discover the best package for your requirements. Go to additional lenders’ other sites and study on the everything they give you. Take note of people limited variations in interest rates or origination fees. The bucks it will save you, in spite of how brief, will add up over go out.

Pro Tip

Fill out re-finance apps for a few some other loan providers. In this three working days, they’ll deliver that loan Estimate, hence traces all the information of potential mortgage. The application form is not a commitment to just one lender, so contrast Mortgage Prices to discover the best terms and you will projected fees.