Shopping for to find home however, would like to get the fresh capital positioned as fast as possible? Continue reading to have information about using connecting funds for domestic buy transactions.

Whenever we think about to order a home, we frequently accept that simply residential mortgages are available to fund the costs – but there are many solutions!

Bridging finance is actually most frequently used for assets development plans or people, however, there clearly was things whenever bridging fund to own property purchase borrowing from the bank is a great service.

How do Connecting Fund getting Home Purchases Performs?

Bridging finance for property purchase deals are a short-title financing, secure against property, and generally operates for under a year.

He could be attention-simply, and that means you repay precisely the focus ability per month, or this is rolling right up to your mortgage and be repayable after the word. The loan was safeguarded up against the possessions, and pick fixed-price fund otherwise tracker money, just as in a typical mortgage.

Brand new vital differences would be the fact connecting financing to possess house get transactions are quicker, and much more flexible, but carry out bring large rates. Loan providers offering connecting funds to possess possessions purchase intentions will not be so concerned about that which you earn, as they will which have the manner in which you propose to pay off the debt – entitled their exit approach.

There’s two center type of bridging loan, so if you’re buying a house to live in, you need managed connecting money for property pick borrowing from the bank.

- Controlled bridging fund try checked of the Monetary Conduct Authority’s criteria, just who place rules around activities such researching suggestions.

- Unregulated connecting financing to possess house sales are geared towards low-residential sales, such industrial expenditures otherwise to get a rental property.

When Any time you Use Connecting Financing to possess loan places Wheat Ridge Family Sales?

So to speak, bridging fund having house orders are timely – they can bring but a few months to finalise bridging funds for house get deals, susceptible to requirements.

If you want to flow quickly with a move, must transfer to your brand new possessions when you find yourself waiting around for your dated that promote, otherwise want to purchase a home that needs significant recovery and you may is known as uninhabitable bridging financing for domestic instructions are a short-identity solution.

Public auction commands are are not financed because of the a link loan. Always, you pay an excellent 10% deposit at the time and have now to invest the bill during the twenty-eight months – otherwise risk dropping the deposit, in addition to assets.

For this reason, connecting finance for possessions commands will likely be install rapidly and you can utilized to cover the balance as you function with getting an effective domestic home loan in place so you’re able to re-finance your debt.

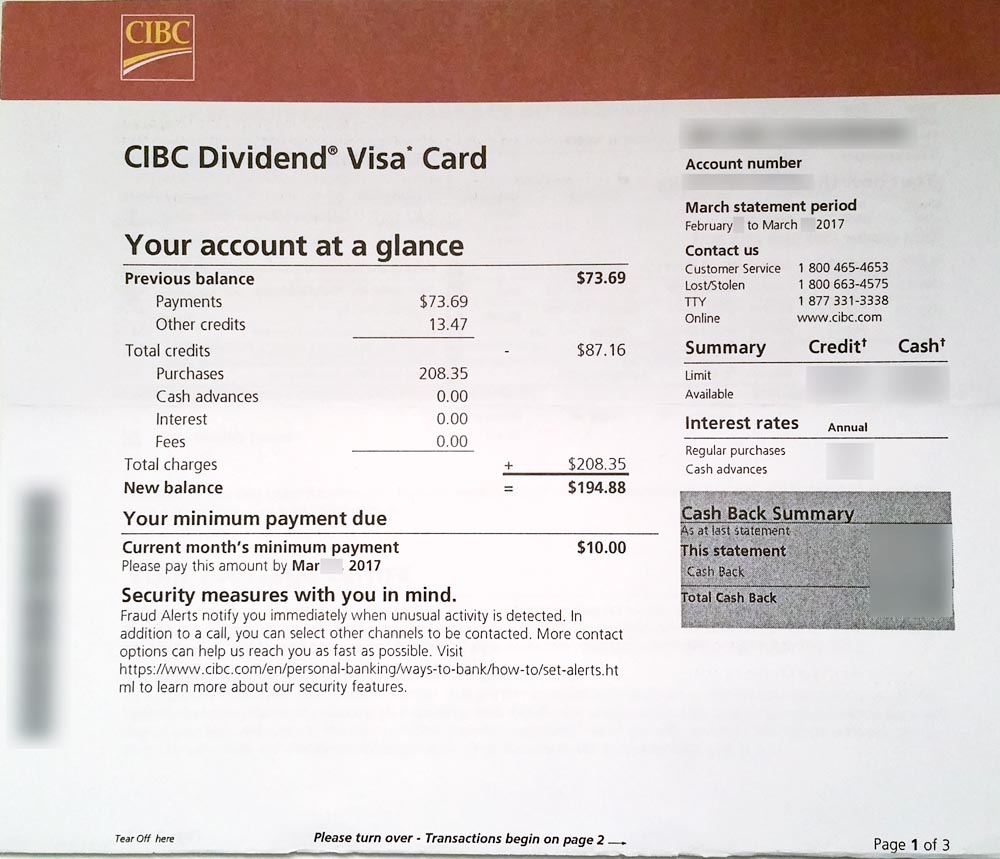

Specific home owners have fun with bridging fund to own property sales while they features been turned down to possess home financing. Eg, when you have a less than perfect credit score on account of an issue that’s due to end from your list in certain days, you might use a connection purchasing your house now, and then remortgage when you can secure most readily useful home loan rates.

Ought i Explore Connecting Funds having Family Investment?

You need to use bridging financing having possessions pick borrowing to order a run down property this is not entitled to a mortgage. You to choice is to take on a link-to-let financing, whereby you agree on a good remortgage manage an equivalent bank, so you can kick in if repair tasks are over.

Bridging financing having family purchases are made use of if you want to order a house market they to possess funds. This can be labeled as flipping property and may incorporate if there was the lowest-listed assets obtainable, or you are given a property within below market price.