Lucas Horton did not predict difficulties as he applied for a home loan. Anyway, their credit history was at new 800s-that’s advanced. And you may, given that holder off a custom precious jewelry tale inside the Dallas, Horton earned a earnings.

Of numerous thinking-functioning gurus, such as for example Horton, not be able to become approved having mortgages. The reasons are many, however, primarily boil down compared to that: Of several thinking-employed professionals don’t possess a vintage income, and thus have to commonly work harder to prove its money. With that in mind, listed below are some ideas to help you get acknowledged to own a mortgage-though you’re their employer:

step 1. Remain tax write-offs to a minimum

It may sound counterintuitive, however, notice-operating professionals is always to discount a lot fewer costs for at least a couple of many years before you apply to have a home loan, says Nikki Merkerson, JPMorgan Chase’s People Reinvestment and Society Partnership Officer.

This is because lenders look at the earnings immediately following make-offs. Thus tax filers whom subtract a good amount of expenses have a tendency to tell you an income that appears far lower than it really is. “Once you submit an application for a home loan, you will want to tell you more funds to purchase more home,” claims Merkerson.

This plan worked for Horton when he reapplied for their financial. By the perhaps not saying as many company costs, he had been in a position to incorporate an extra $twenty-five,100 so you’re able to his income. “Regardless if I got to blow way more taxes, it absolutely was beneficial to get the home i need,” he states.

dos. Decrease your debt

When Horton’s financial institution refuted his financial, it pointed out that he previously $31,one hundred thousand for the education loan loans, hence made their personal debt-to-income proportion-the fresh new portion of his gross monthly income you to definitely goes toward their monthly expenses-unacceptably higher. To fix the issue, Horton dipped on their coupons and you may paid more than 80 % regarding his student loan financial obligation at once. Which reduced their personal debt-to-earnings proportion rather and you will cleaned ways having his home loan to your a $195,100 household.

Debt-to-earnings ratio performs an enormous character into the even if you get approved for a financial loan as well as how much you could potentially borrow. Even though you have good credit history, you should aim to keep your loans-to-earnings ratio less than 43 percent.

3. Keep meticulous information

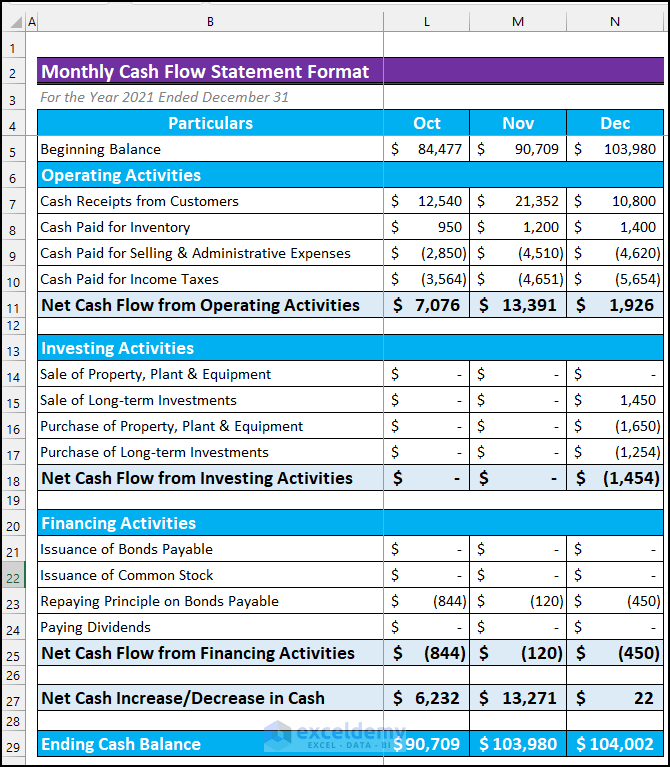

Very salaried employees only have to inform you W-2 models to show its income. Self-operating gurus, simultaneously, must show a number of data files, along with 24 months of personal and you may providers taxation statements, Agenda Cs, 1099s, K-1s, profit-and-loss comments, as well as 2 months from bank comments. And, whenever they shell out by themselves a salary, they need to give W-dos variations using their organization.

It also helps to save invoices and you can independent specialist arrangements, while they can also support the job. “One file you could provide that can help underwriters observe much money you’re currently and also make is obviously of good use,” says Merkerson.

4. Independent yours and you may company expenses

When loan providers consider how much cash financial obligation you have got, they truly are simply loan places Howard deciding on yours financial obligation, not your company debt. This is why Merkerson suggests notice-functioning consumers to split up the individual and you can team expenditures.

Preferably, you’ll have separate handmade cards, examining and deals levels. You ought to debts any organization transactions, like the purchase of a special dining table or dinner having a possible buyer, toward appropriate account. This will clarify your own taxes which help you retain track of money arriving and you may going out of your business.

5. Create more substantial advance payment

Consumers will see you to definitely, the greater their deposit, the easier it is so they are able get home financing. A more impressive sum reduces the count that really must be lent and reduces the borrower’s threat of standard, which seems more suitable on the sight of your own loan providers. “More you put down, the latest stronger the file is,” says Merkerson.

As soon as your funds come in order and you can you gained every needed paperwork, you’ll be inside a much better reputation to look around for mortgages. On right prep work, possible cope with the borrowed funds procedure having partners surprises.