Ans: Providing a personal bank loan from your own manager to purchase a property can also be notably effect debt believe and you may taxation disease. It plan pertains to monthly EMI write-offs from your own paycheck, hence introduces questions regarding taxation ramifications. Why don’t we mention this comprehensively.

Knowledge Manager-Disbursed Personal loans Boss-paid unsecured loans are advantageous as they usually have down interest rates and you will smoother repayment terms.

Income tax Ramifications with the Company Fund In the event your manager disburses a beneficial financing, it is far from instantaneously experienced section of their nonexempt money. Yet not, certain issues is dictate just how it payday loans Sugar City is taxed.

Perquisite Value Computation The brand new perquisite well worth ‘s the difference between new business interest additionally the concessional rates toward loan amount

Exclusion Constraints Loans for homes as much as Rs 20 lakh typically has actually specific tax exemptions. When your loan amount exceeds Rs 20 lakh, the whole amount get attention various other income tax providers.

Monthly EMI Deductions and you can Tax Month-to-month EMI deductions do not individually decrease your nonexempt earnings. Yet not, the attention part of the EMIs may have income tax effects.

Notice to the Loan The eye portion of your own EMI is claimed given that a deduction significantly less than Part 24(b) of your own Tax Work, as much as Rs dos lakh yearly to own a personal-occupied household. It reduces your taxable earnings.

Prominent Repayment The main portion of their EMI will be advertised below Part 80C, at the mercy of the entire restriction out of Rs 1.5 lakh. This facilitates cutting your taxable earnings.

If your financing emerges on an effective concessional interest rate, the essential difference between the market rate and concessional speed are considered a great perquisite

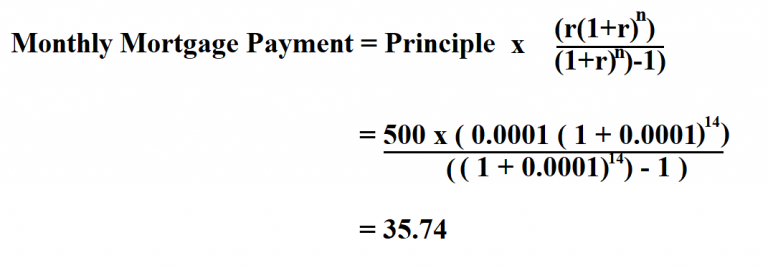

Example Computation Why don’t we split so it down having an illustration to make it sharper. Imagine your own yearly income try Rs 10 lakh, and also you take an effective Rs 20 lakh loan within an excellent concessional rate off 4%, because the markets price was 10%.

Perquisite Worthy of = (ount Perquisite Really worth = (10% – 4%) * Rs 20 lakh Perquisite Really worth = 6% * Rs 20 lakh = Rs step one.dos lakh So it Rs step 1.dos lakh are put in your nonexempt money.

Attention Deduction Imagine the attention paid-in a year are Rs 80,000. You might claim to Rs dos lakh around Point 24(b), therefore cutting your taxable money.

Prominent Deduction Imagine the primary repaid in a-year is actually Rs 1.dos lakh. You might claim so it lower than Area 80C, as much as the brand new limitation away from Rs 1.5 lakh.

Less: Part 24(b) Deduction = Rs 80,000 Quicker: Section 80C Deduction = Rs 1.dos lakh Internet Taxable Income = Rs eleven.2 lakh – Rs 80,000 – Rs step one.2 lakh = Rs nine.2 lakh

Benefits of Employer-Paid Loans Boss-disbursed financing are advantageous because of lower rates and you will basic running. An important experts is:

Monetary Believe which have Boss Financing Strategic Use of Deductions Maximise your own income tax benefits by using Section 24(b) and you may Section 80C deductions. Bundle your bank account to be certain you fully apply these areas.

Cost management for EMIs Make sure your month-to-month budget caters brand new EMI deductions conveniently. It will help during the maintaining monetary stability versus compromising toward most other costs.

Disaster Finance Take care of a crisis funds to manage one economic contingencies. It implies that debt plan remains focused even with unforeseen costs.

Top-notch Information Formal Economic Planner (CFP) Contacting an authorized Financial Planner also provide designed suggestions about handling the loan and you will tax implications. A CFP will help optimise the income tax positives and funding strategies.

Regular Financial Recommendations Make normal monetary recommendations to evaluate the latest feeling of the mortgage on your own overall financial wellness. So it means that you remain on track along with your economic wants.

Latest Understanding Boss-disbursed unsecured loans to own household get have several advantages and you can income tax effects. Because of the knowledge these types of facets, you can make told decisions and optimize debt thought.

Their diligent method of controlling your money try good. With proper think and you will professional information, you might efficiently manage your loan and increase tax benefits.