The current Pricing getting Very first time Homeowners for the Louisiana

Home loan costs has reached step 3.00% for the 30 seasons fixed loan program and also at dos.56% towards the fifteen season fixed. In terms of variable prices, the 5/1 Case rates currently really stands in the 4.56%. Check out FHA and you may Va cost as well if you find yourself undertaking reduced if any down money.

step one. Select loan apps that may suit you. When you are moving to a qualified city, you may qualify for a zero advance payment mortgage courtesy USDA. Experts and effective responsibility army may be qualified to receive Virtual assistant financing, that do not wanted dollars off. The content regarding the paragraphs less than will be leave you a thought off the place you will get slip.

2. Know your credit score. Essentially it has to slip someplace a lot more than 600, but a few loan providers take on scores on high 500s. When your credit rating demands an increase, manage boosting they one which just you will need to pull out a mortgage. Immediately following annually, you are able to request a free credit file throughout the around three big credit reporting agencies.

step 3. Shop rates of interest out-of some other Louisiana lenders. Pick one which besides will bring good render, however, carries a top get on Bbb.

4. Score pre-accepted. Once you’ve compensated on a loan provider, likewise have money documents together with your past a few pay stubs and you may taxation output regarding prior 2 years.

5. Determine your budget. You might be pre-accepted for a financial loan count that is bigger than you had forecast, but never ft your financial allowance towards sum given. Remember – pre-approvals aren’t a guarantee to help you give, and simply you know what you can it’s pay for.

six. Start interested in the new household. At the same time, make sure to avoid and work out highest sales, taking out new payment fund, otherwise other things that’ll weaken your financial status. Loan providers commonly look at your membership once more prior to closure the loan.

If you find yourself a first and initial time home visitors instead a lot to set out, a good Louisiana FHA mortgage may fit your. FHA money was supported by the us government and you may built to help home buyers which have restricted upfront fund located investment.

- loans that accept chime

- Down payment: 3.5%

- Minimum appropriate credit history: 580 (varies)

- Home loan insurance coverage: Upfront (1.75% loan amount) and you may monthly

- Assets guidelines use and generally are affirmed via domestic examination

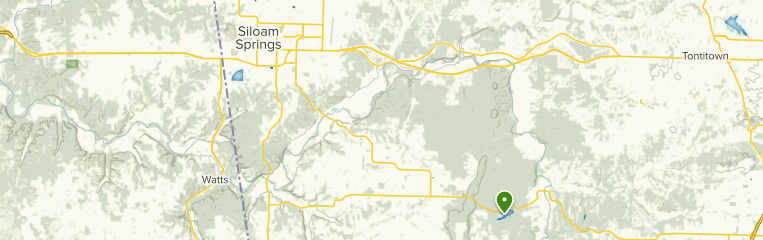

The united states Agencies out-of Farming backs mortgage brokers to have zero down seriously to Louisiana home buyers looking to proceed to or real time in the rural portion. Find out if the to order urban area is approved because of the lookin new USDA’s assets map. Remember that well-known elements like This new Orleans, Baton Rouge, and you will Shreveport aren’t qualified.

- Down payment: Not one necessary; capital up to 102% offered according to domestic assessment

- Lowest acceptable credit rating: 620

- Mortgage insurance rates: Initial (2% loan amount) and you will month-to-month

- Money maximums apply

Louisiana Grant and you can Direction Apps

The new Louisiana Houses Company (LHC) will bring affordable, lowest inteterest, 31 seasons repaired-rates mortgage loans to help you eligible homebuyers through the . Included was advance payment or closing pricing advice from the form regarding a give equal to 3% the borrowed funds number. The 3% is a profit gift and want not repaid. Income and you can assets speed constraints (put of the FHA, Va, and you will USDA) incorporate, however, there are no venue restrictions popular towns and cities including The fresh Orleans, Baton Rouge, and you can Shreveport meet the criteria. Are designed home are not eligible.

LHC also provides a great many other financial guidelines apps which go inside and out-of availableness on account of minimal finance. Of numerous offer advance payment grants and you will closure prices features. Take a look at authoritative webpages to find out more and you can a full listing away from programs, as well as Markets Rate GNMA.