When you find yourself Personal loans are in fact offered, it is essential to feel an accountable borrower and just apply getting like finance when you need them. Here are a few four conditions in which a personal loan is sensible.

India possess mostly started that loan-averse country. A lot of people, particularly the seniors, choose life style in their mode and you may preserving money for hard times as an alternative than just credit and you can paying off. While this therapy does have its advantages, there are several days inside our modern existence in which taking Individual Finance produces much sense.

1. Medical Problems

Even though you possess an urgent situation funds for scientific expenses, the high cost of medical care in the country will helps make including fund inadequate. Furthermore, the sort of such issues can be in a fashion that you need quick access to financing. A number of the banking companies today approve Signature loans on a single day’s application with the intention that you could create including issues and can supply the good healthcare to the loved ones. Having lowest Consumer loan qualifications conditions, become rest assured that the probability of financing approval was large.

dos. Using Credit cards

While Credit cards are strong monetary gadgets, they’re a burden otherwise used responsibly. Once the interest out of Personal loan can be lower than compared to Credit cards, delivering an unsecured loan to spend Bank card bill are an effective smart decision as well. You could just take a personal bank loan and then pay-off a similar from inside the month-to-month instalments over a tenure loans in Sylvan Springs of 1-5 years. This can help you rescue a lot of money.

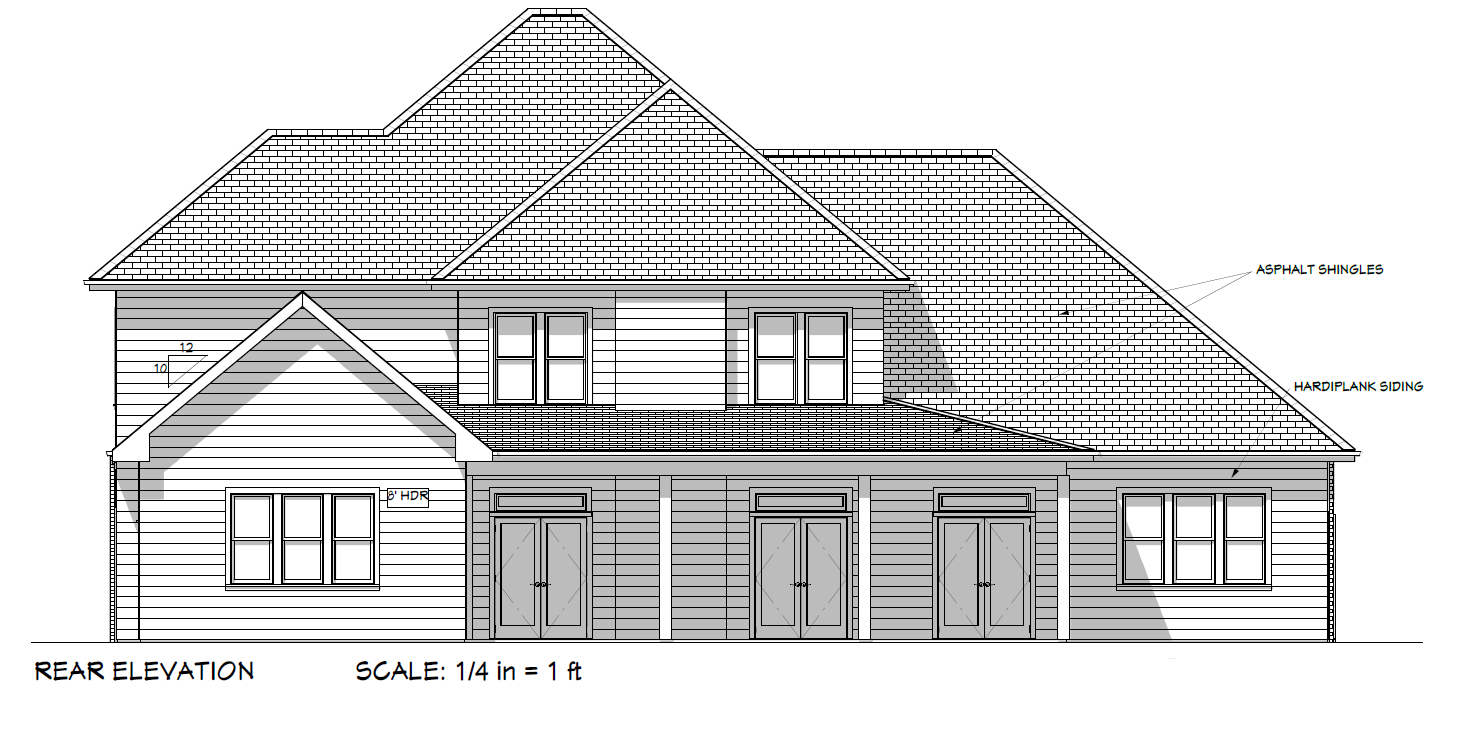

step three. Home Repair

A new circumstances in which you might require a personal loan are household restoration. There are numerous sort of renovation standards from a house that are day-painful and sensitive. As an example, repairing a primary leakages through to the monsoon or and also make certain developments towards the house before trying to market a comparable. If you do not provides enough deals for instance home improvements and you will advancements, an unsecured loan normally really well create the expense. Because there is not any restrict precisely how the loan amount can be be taken, Unsecured loans are highly flexible.

4. Degree

The job sector inside Asia as well as around the world was today very competitive. This will make it extremely important when it comes to working professional to improve the studies and you will experiences regularly. Nowadays there are many different types of programmes which can help you to improve their/their own job candidates. When you are not able to create new charges of such courses on your own, taking an unsecured loan will be a great choice. This should help you benefit from finest elite group opportunities and earn much more. Because Personal loan criteria are often minimum, even somebody who has has just become operating get the loan recognized.

5. Relationships Expenses

Large pounds weddings are slightly a norm in the country. Definitely, the complete matrimony fling can be pricey. In the event it is your wedding otherwise of somebody in all your family members, a monetary setback is certainly caused by unavoidable. A consumer loan is a great way to perform the costs out of a wedding. Having financial institutions now providing Signature loans of up to Rs.20 lakh, you’ll be able to have the financial assistance you need to take pleasure in the wedding exactly as you’d dreamed.

Taking advantage of a consumer loan

Every type out of financing is right so long as you understand what you are really doing and also have a strong fees bundle for the put. Whenever you are you can find circumstances in which delivering an unsecured loan tends to make feel, the people listed above try few of the finest instances.

Make use of the Personal loan eligibility calculator on the internet to evaluate your qualification before applying so that your loan software is instantly approved without the problems.