In this article, we are going to assist you tips power the fresh equity on the household or money spent with a property guarantee credit line, as well as how that may equivalent so much more money in the long run

You’ll leverage household security to have any type of mission you select. Privately, I like financially rewarding financial investments that grow to be exponential productivity while using lent currency.

Everyone desire where we might purchase the money if we’d they. We feel about what we possibly may create involved one day. I give ourselves, I am going to save adequate to dedicate soon. But what if the there can be an easy method? Investing doesn’t need to getting such a frightening task. Stay glued to us and we will show you exactly how far more debt can also be in reality equivalent extra money.

Whether you are using the collateral of your house to find other house inside the Canada or you’re playing with domestic collateral to order several other domestic otherwise a rental property in Canada, the concept of leverage is basically very easy. Even more financial obligation can be equivalent extra cash! The audience is breaking down several easy basics (with a wholesome amount away from vocabulary) so you’re able to greatest see the money-generating possible on your latest house resource. Read on or observe the fresh new videos less than understand how-to play with collateral purchasing a moment domestic for the Canada.

Household equity, essentially, is the currency you reside and work out to you. Since the possessions you bought values usually, it becomes really worth even more than what you purchased they. Even though you don’t want to sell, you might still use the worthy of it’s got generated over an excellent time period to find a moment domestic. You are able to the house’s appraised really worth to help make the off commission for another property, should it be a secondary house, the second home, accommodations possessions otherwise. Making use of the collateral in your home to order a property and you can generating a lot more efficiency tends to make more financial experience than simply allowing it sit around and allowing that extra really worth check out waste.

Many people have fun with domestic security to acquire an additional house within the Canada otherwise trips family for recreation while some exercise to own resource aim. Regardless, before you could in reality use your collateral, it is very important cautiously consider the choices, whether you’re to purchase a secondary house or a house to produce a steady stream off rental income. If you’re looking buying accommodations second property, understand that a condo offers the highest returns for the forget the. Already, lack on the housing marketplace have led to lower vacancy cost, which often has actually contributed to a good love regarding condos (much more about this in the last point). payday loans no bank account Coleytown CT No matter what variety of houses alternative you’re interested in, be sure to get an estimate of the cost of the property you’re looking to acquire to the guarantee of your home. 2nd, i deep-dive into the material if you take a close look at the particular of your guarantee words.

A Obligations in the place of Bad Personal debt

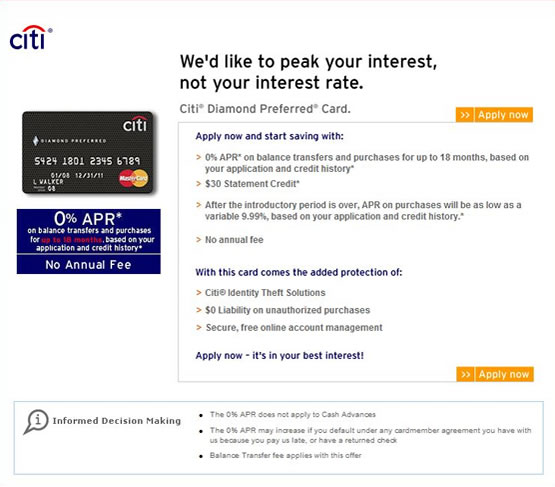

Though loans sells an awful meaning, there can be nothing nearly as good personal debt, as well. Generally, a financial obligation grows your net really worth and you will/or helps generate well worth (i.elizabeth. taking out home financing, borrowing from the bank college loans or being able to access a personal line of credit in order to consolidate debt), while you are crappy obligations generally speaking uses lent currency (i.elizabeth. playing cards, pay day loan, etcetera.) to acquire services and products or characteristics that have no lasting well worth, such as a like vehicles or question issues cannot thinking about reselling. Aren’t getting united states completely wrong, we love toys and you can glossy anything as much as the following people, but regarding a good investment view, they’re not planning reinforce debt collection. An effective personal debt isn’t one thing to love financially, and will indeed end up being a advantage if the put correctly.